In honour of the fact the year is almost over I thought I would ask you this question:

In honour of the fact the year is almost over I thought I would ask you this question:

How have you done over 2016 on accomplishing your one thing for the year? Your one great priority? Have you moved the dial forward this year?

Setting goals gives you long-term vision and short-term motivation. But what is your Priority -your “One Thing”? Many people have “Priorities” – but what is your “One Thing?”

It’s interesting to note that the word priority came into the English language in the 1400’s. It was singular. It meant “the very first or prior thing.”

Only in the 1900’s did we pluralize “Priority” thus giving us the false idea that all of a sudden we have the ability to multiply “first things” thus leading to a lack of focus and clarity.. No wonder we are confused and overwhelmed with “priorities” instead of “one thing”. With this in mind, search within yourself for the answer to what is your “One Thing”.

Goal setting is a powerful process for thinking about your ideal future, and for motivating yourself to turn your vision of this future into reality. – We all know this, yet many of us have not seriously written down or measured our Goals. Many people feel life is too unpredictable to make plans beyond this year’s holiday, and even that’s a bit of a stretch. Most people have general intentions – but many don’t have goals. It’s great to have intentions and goals… but it is integral to commit to ONE THING being the priority for the quarter or year. Think about it… when you begin to work on Quarterly Priorities and have more than three, many times by the time a quarterly review comes around, the leadership team has lost sight of what that One Thing is. How do you move the dial forward?

Ask yourself this question: “would you set out on a major journey with no real idea of your destination?”

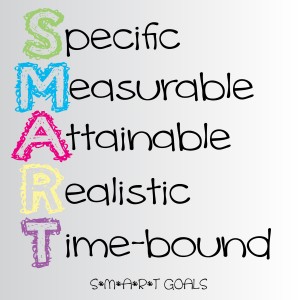

A useful way of making goals more powerful is to use the SMART mnemonic. Ensure that your goals are attainable: Don’t set yourself up for failure by aiming for out-of-sight goals. Choose smaller goals that you can use as stepping stones toward a bigger, long-term achievement. For example, a runner might dream of completing a marathon, but set a short-term goal of running 10 miles a week for two months.

Ask yourself whether or not the activities that you choose to support your priority are 90% or more on target of attaining that measurement?

Make sure your priority has a metric to measure and answer the following questions:

- “HOW WILL WE KNOW WHEN WE’RE DONE?”

- “How will we know when we have succeeded?”

You achieved a Goal… Now What?

It’s important that when you’ve achieved one of your goals, take the time to enjoy the satisfaction of having done so. Absorb the implications of the goal achievement, and observe the progress that you’ve made towards your other goals.

If the goal was a significant one, reward yourself appropriately. All of this helps you build the self-confidence you deserve. You have indeed moved the dial forward.

With the experience of having achieved this goal, review the rest of your goal plans:

- If you achieved the goal too easily, make your next goal harder.

- If the goal took a dispiriting length of time to achieve, make the next goal a little easier.

- If you learned something that would lead you to change other goals, do so.

- If you noticed a deficit in your skills despite achieving the goal, decide whether to set goals to fix this.

And more importantly, know that failing to meet goals does not matter much, just as long as you learn from the experience.

Work–life balance is a concept including proper prioritizing between “work” (career and ambition) and “lifestyle” (health, pleasure, leisure, family and spiritual development/meditation). This is related to the idea of lifestyle choice.

Work–life balance is a concept including proper prioritizing between “work” (career and ambition) and “lifestyle” (health, pleasure, leisure, family and spiritual development/meditation). This is related to the idea of lifestyle choice.

Of course everyone’s priorities change depending on a range of factors. For example, age can make your balance very different.

If you’re in your twenties or thirties, you may have strong commitments to building a family life whilst, at the same time, focus on growing your career.

If you’re in your fifties and sixties, on the other hand, your focus may be on more personally meaningful and purposeful activities, which may not have been present earlier in life.

Whatever you do to establish your work/life balance, it’s vital to create it and keep to it whenever possible.

Moving the dial at home, too

Achieving the balance between work and personal life is becoming increasingly difficult due to the pressure current society has placed on individuals.

Now that you know the best practices for goal setting, it’s time to start thinking about your family’s hopes and dreams. Could your family find ways to spend more time together? Family goals focus on achieving accomplishments agreed upon by the family. The family individuals need to work as a team to collectively identify and establish goals for the family unit… Setting family goals helps you to focus on the family and achieve work life balance. It’s all about balance!

We at Priority Leasing are wishing you all great success in work and life and in finding the right balance for you and in setting your goals and moving the dial forward in 2017.

Deb Sands

President

P: 403-216-1930

C: 403-703-7301

W: https://priorityleasing.net

Did you know that you can lease everything you need to outfit the extra office… even artwork… and you can include the lease payment in the tenant’s rent?

Did you know that you can lease everything you need to outfit the extra office… even artwork… and you can include the lease payment in the tenant’s rent?